Overview

The Server Management page is only accessible by users with Admin privileges. This page allows the user to set general global settings that affect all locations, groups, and users for the system.

On this page

| Table of Contents | ||||

|---|---|---|---|---|

|

Overview

The Server Management page is only accessible by users with Admin privileges. This page allows the user to set general global settings that affect all locations, groups, and users for the system.

Server Management and System Options

The Server Management page displays a list of available system options as well as a list of all current account administrators for the entire FasCard System.

| Note |

|---|

PLEASE NOTE: Selections on the Server Management page SUPERSEDE any selection within the FasCard System. If the feature is NOT selected on the Server Management page, but is selected elsewhere in the FasCard Admin System, the feature will NOT work. |

| Info |

|---|

More information regarding account privileges (including Account Admins) can be found on the FasCard Admin Site - User Accounts page. |

System Options

The System options section is where CCI sets up the system and designates what type of payments the machines within the FasCard System will accept, which credit cards will display on the reader, as well as authorization amounts for credit cards. ALL of the options under the System Options section are configured by CCI, including CCI Support. CCI Support is checked by CCI on account setup, only on customer request. The customer can choose to uncheck the CCI Support option at any time.

| Note |

|---|

PLEASE NOTE: If CCI Support is unchecked, CCI Tech Support will not be able to access the customer's account in order to troubleshoot. |

See below for further detailed descriptions of these fields as well as which products are applicable.

Field | Description | Applicable to FASCARD and FLEX Products | Image | Additional Fields to Configure for Optimal Performance | Image | Additional Fields to Configure for Optimal Performance | Image |

|---|---|---|---|---|---|---|---|

Accepts Coins | When checked, all the readers will enable coin features. **When unchecked, no other coin-specific features will work on the system. | FASCARD: YES FLEX: YES |

| ||||

Accepts Credit Cards for Adding Value | When checked, all readers will allow customers to use credit cards when adding value to their account. | FASCARD: YES FLEX: YES |

| ||||

Accept Credit Cards for Adding Value via the FasCard Mobile Site or App | When checked, customers will be able to use credit cards to add value via the FasCard Mobile Site or App. | FASCARD: YES FLEX: YES | |||||

Accepts Credit Cards for Machine Starts | When checked, all readers will allow customers to use credit cards to start the machines | FASCARD: YES FLEX: YES |

|

| |||

Accept NFC mag stripe | When checked, all 3rd Generation (F3) FasCard* readers will accept payment from tap-to-charge cards and devices with NFC (Near Field Communication) capability simply by holding the card or device close to the reader. NOTE: This function only affects readers and Add Value Kiosks that use an F2 reader. Touch Kiosks unaffected. *You must have the proper gateway (Worldnet) and merchant account set up for this feature to function. | FASCARD F3 | |||||

Accept EBT payment | When checked, EBT cards will be accepted* on all touchscreen FasCard readers, Add Value Kiosks using a touchscreen FasCard reader, and Touch Kiosks. *You must have the proper gateway (Worldnet) and merchant account set up for this feature to function. | FASCARD: YES FLEX: YES* | |||||

Allow Loyalty | When checked, all readers will allow loyalty program, accumulating points or redeeming points. | FASCARD: YES FLEX: YES |

| ||||

Enable Location Groups | When checked, accounts with multiple store locations can now be grouped together into clusters of location groups using the Location Groups sub-tab. | FASCARD: YES FLEX: YES | |||||

CCI Support | Enabling this check box grants CCI technical support access to system. Without this option enabled, access is restricted to users granted "Website Privileges" on the User Accounts page. | FASCARD: YES FLEX: YES | |||||

Displayed Card Brands | When the cards are checked, they will display on the F2 or F3 Reader | Applicable when FASCARD and FLEX products are accepting credit cards |

Environment

| Note |

|---|

This field is only configured by CCI Internal Staff when the FasCard account is created. FasCard Admin Users CANNOT change this setting. |

The FasCard System can be used in different types of environments, from a Laundromat to an Apartment Buildings. The descriptions of each of these environments are below.

Field | Applicable to FASCARD and FLEX Products | Image |

|---|---|---|

| FASCARD: YES FLEX: YES |

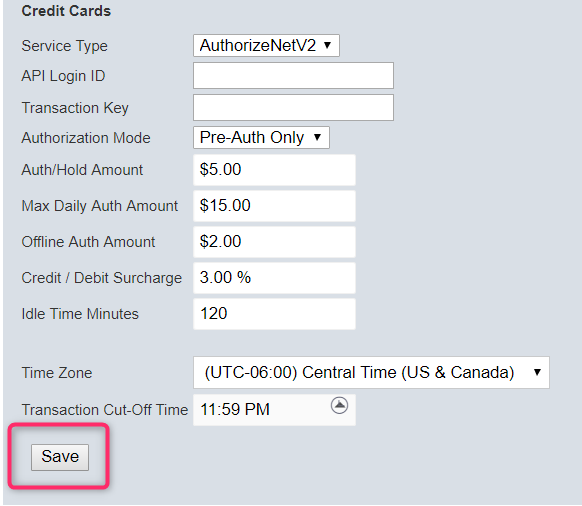

Credit Cards

If the store is setup to take credit card payments, the information under the Credit Card section should be completed. There are a few fields that CCI must configure before the store can be ready to accept credit cards. They are noted below.

Field | Definition | Image | ||||||

|---|---|---|---|---|---|---|---|---|

Service Type** **This field is used by CCI only. | This field indicates the gateway service used by the FasCard account. There are multiple different gateways that may be used, depending on the account setup. Set up through CCI, different gateways may provide different functions and setup parameters. More information may be reviewed here: Credit Card Informational Article.

| |||||||

Authorization Mode | Authorization Mode - This option allows an owner to choose which type of Authorization to use for their system.

| |||||||

**Note** This feature does not apply to "Add Value" transactions using a credit card.

| ||||||||

Max Daily Auth Amount | This field indicates the maximum amount that may be authorized per credit card per day. This is set to $200.00 by default. If this is set to $0.00, credit cards transactions will not process. | |||||||

Offline Auth Amount | This field indicates the maximum amount to permit a customer to charge with a credit card when the satellite cannot connect to the FasCard servers. The satellite will attempt to charge the total amount of all customer transactions processed while offline - this depends upon availability of funds on the credit card and is subject to denial for standard reasons. These are delayed authorization attempts that will only attempt to process when the satellite is online again.

| |||||||

Credit/Debit Surcharge/Discount | This field is where a surcharge or a discount amount can be set (by the Owner).

IMPORTANT NOTES ABOUT SURCHARGES::

| |||||||

Surcharge Mode | None - When selected, no surcharge is added for credit/debit card use | |||||||

Idle Time Minutes | This field indicates the amount of time that the system will wait after a card is last used before it reconciles the actual transaction amount for an individual credit card. | |||||||

Time Zone | This field indicates the time zone that will be indicated in the timestamp of individual credit card transactions. | |||||||

Transaction Cut-Off Time | This is the time that designates the end of one business day and the start of the next. This should be set to match the time that Authorize.net is configured to use. Typically this is configured by CCI support- this field should only be changed under the supervision of CCI support. | |||||||

Save | Click this button to save any changes made on this page. |

| Tip |

|---|

TipIt's important to keep in mind when configuring 'Idle Time Minutes'. Transactions that are captured after the 'Transaction Cut-Off Time' will be not be picked up by the gateway provider (Authorize.net) until the next business day. |

Account Admins

This section of the page lists the name and email address of all of the admin users that are configured for the system. These users have full access to the system. As a best practice for secure systems, it is recommended to keep this list to a minimum to prevent unauthorized changes to the system.

Employees to be notified of app feedback

This section lists names and email address of any users that are configured to receive a notification for when customers submit any feedback via the FasCard Mobile Site or App depending on whether users are set up to be notified for any one or all locations under the account.

| Note |

|---|

Environment & Billing These account fields are only accessible to CCI administrative personnel. If either or both the Environment and Billing sections are visible, notify CCI Technical Support immediately. |